The plastics segment is impacted by environmental awareness and stricter regulations, which could negatively affect businesses in the near future.

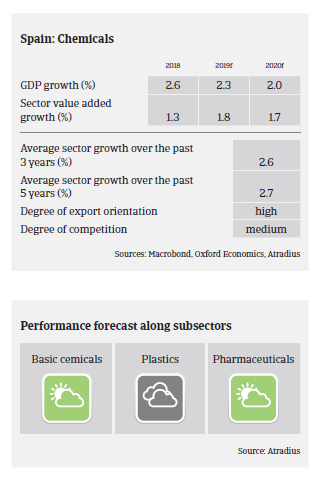

- Turnover in the Spanish chemicals sector increased 4% in 2018, to EUR 66 billion, with 58% of production sold abroad. Profit margins are expected to remain stable in the coming 12 months, supported by domestic economic growth, further rising exports and the ability to pass on any price increases to end-customers.

- Access to bank financing has improved in recent years, both for short-term financing (working capital management) and long-term facilities (i.e. capital expenditure financing).

- On average, payments in the Spanish chemicals sector take 60 days and payment experience has been good over the last two years. The number of non-payment notifications and insolvencies was low in 2018 and no substantial increase is expected in 2019.

- Our underwriting stance for the basic chemicals and petrochemical subsectors is open due to the good business performance and credit risk situation. The same accounts for pharmaceutical businesses, which generally have shown sound operating margins and excellent payment behaviour in recent years.

- That said, we take a neutral stance when underwriting the plastics segment, which is impacted by increased environmental awareness and stricter regulation (e.g. the EU plans to ban the use of single-use plastics by 2021). This could negatively affect businesses in the near future.

- When underwriting the chemicals industry it is important to assess for every single company how the evolution of commodity (mainly oil) prices could affect cash flow generation and to look at the ability to pass on any input price increases.

- We pay special attention to highly geared businesses, assessing the evolution of the debt burden and the final use of any significant debt increase. We also pay special attention to the existence of unused committed credit lines and the maturity profile of long-term debt.

Related documents

826KB PDF