In today’s fast-changing and increasingly complex global trade environment, shifts in national trade policies can ripple across multiple industries, impacting everything from core operations to entire supply chains. Understanding how businesses are coping with this uncertainty has never been more critical.

Uncertainty and profit margin pressures cloud outlook for US firms

As high uncertainty continues to cloud the global trading environment, B2B suppliers in the US are split on whether customer insolvencies will increase in the months ahead. While nearly half anticipate a worsening insolvency outlook, the other half expect stability. By contrast, companies appear more aligned in their approach to working capital management, showing a shared focus on maintaining financial resilience during an unpredictable trading environment. Most firms anticipate Days Sales Outstanding (DSO) will stay the same or shorten, highlighting efforts to strengthen cash flow through more efficient collection practices.

Companies in the US are responding with a blend of confidence and caution to the evolving global trade landscape.

US business sentiment on potential trade policy changes

Our survey results show a broadly confident stance. On a scale of 1 (Not confident) to 5 (Very confident), the average confidence level was 3.95. Nearly three-quarters of respondents (73%) - especially mid-sized to large manufacturing and service firms without multinational status - feel well-equipped to manage shifts in national trade policies. Another 22% reported a more neutral or cautious position, while just 5% expressed low confidence, indicating limited widespread concern.

When asked which business functions are likely to be most affected, 60% cited supply chain management as the top concern. This was followed by import/export costs (55%), regulatory compliance (49%), and market access (41%). While customer relationships (34%) and financial planning (23%) were seen as less exposed, they still remain areas of attention. These concerns were consistent across sectors and business sizes, though particularly pronounced among large and non-multinational companies.

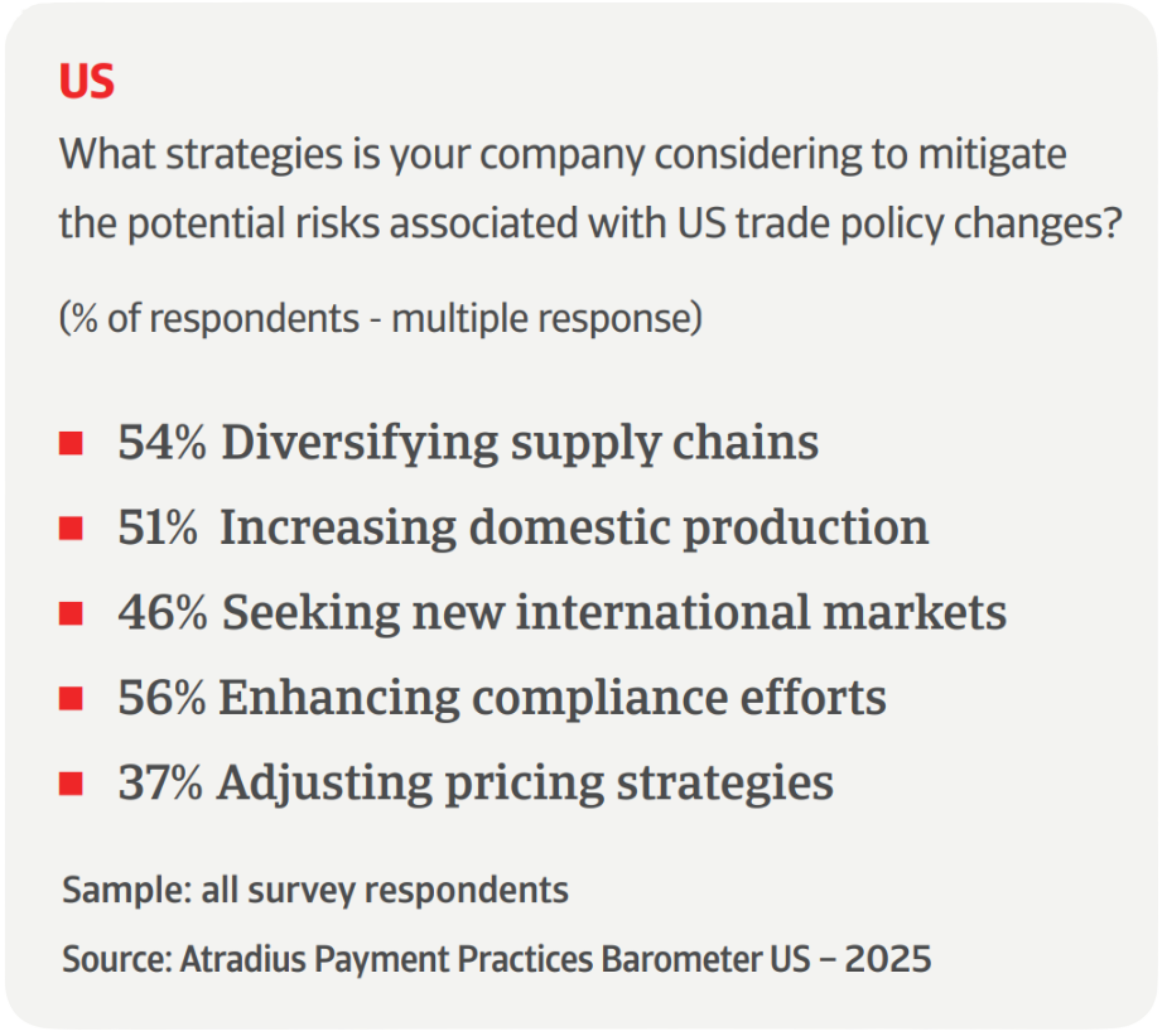

Faced with these pressures, companies are taking strategic action. A majority (56%) plan to enhance regulatory compliance, while 54% are diversifying supply chains, highlighting a strong focus on reducing risk and improving resilience. Over half (51%) are increasing domestic production, and 46% are seeking new international markets to maintain global competitiveness. Adjusting pricing strategies (37%) also suggests rising awareness of margin pressures in today’s unpredictable trade landscape. Notably, the most common approaches centre around supply chain diversification and boosting domestic production, pointing to a clear shift towards operational self-reliance.

Interested in finding out more?

For a complete overview of the 2025 survey results for the US, download the full report available in the related documents section below.

To explore how these insights can strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

- US companies are approaching trade policy uncertainty with a balanced mix of confidence and strategic planning

- While the overall outlook is cautiously optimistic, US firms are clearly not standing still and are positioning themselves to remain agile and financially resilient