Global overview

Disruption of supply chains and rising costs due to tariffs

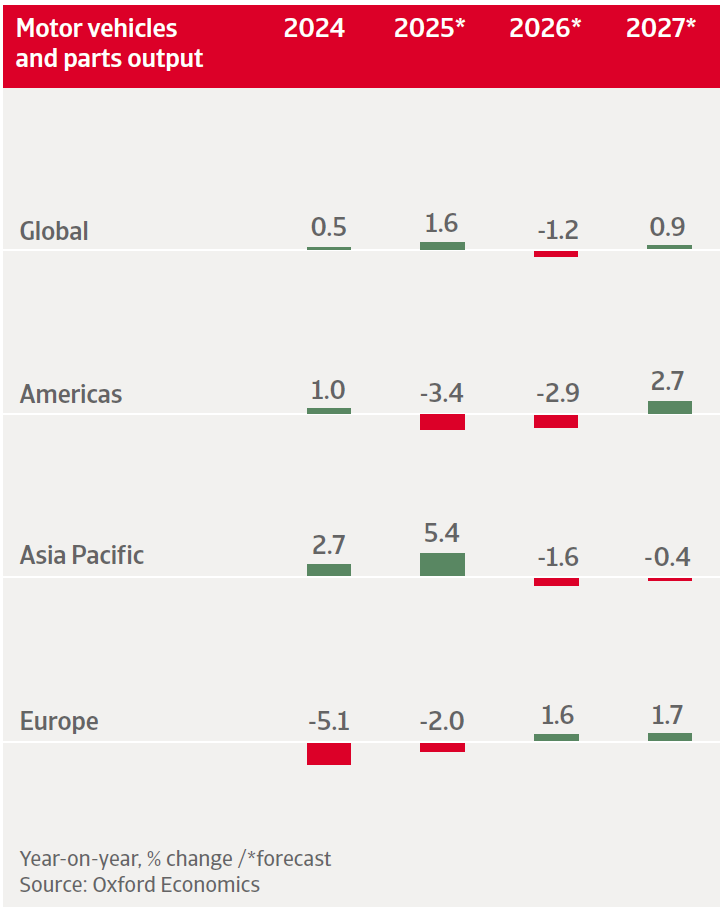

We expect global motor vehicles and parts production to grow by 1.6% in 2025, followed by a 1.2% contraction in 2026. This decrease is partly due to the 15% import tariffs the US has imposed on its major automotive trading partners.

Tariffs will create headwinds in the US, where nearly half of cars are imported, and will affect the regional and global supply chains, increasing the costs of imported components and materials.

Chinese rare earth export curbs have been suspended for the time being. This has provided some relief for Western automotive producers. Restrictions would have affected critical minerals in the production of electric vehicles (EVs) and other electrical systems.

However, businesses should expect continued volatility given the one-year timeframe and lack of a formally signed agreement. Breaking China´s commanding position in the rare earths sector will remain a long-term challenge.

Currently electric vehicle sales are facing headwinds in the US, as the government has rolled back EV tax credits. In Europe´s main markets demand for EVs is growing only slowly. In China, the EV transition maintains a strong momentum. We expect global hybrid and EV sales to account for 59% of global light vehicle sales by 2030, up from 10% in 2020.

USA

Tariffs trigger lower production and sales, but sector remains stable

After an expected 3.5% decrease this year, we forecast US automotive production to contract by 4.5% in 2026, as tariffs and policy reversals weigh on both production and demand.

We forecast car sales to contract by 4.0% in 2026. However, risks are decreasing, as US household spending should be supported by additional interest rate decreases and personal tax cuts.

Although tariffs continue to dominate earnings calls, putting pressure on margins for OEMs and suppliers, the sector remains fundamentally sound. Insolvency levels in the US automotive industry are holding steady, and no significant increase expected in the near-term.

OEMs from around the world announced significant US production capacity investments in 2025. These moves represent clear efforts to circumvent tariff hurdles. However, the industry remains highly capital intensive, and these investments will require time to generate positive results.

Supply chain restructuring will remain a multi-year process, as manufacturers work to reshore production and diversify supplier networks. Tariff policies will keep supply chains and pricing under pressure.

In the EV segment the roll back of tax credits will reduce incentives for EV adoption, just as US automakers seek to expand in that segment.

Canada

Tariffs and plant shutdowns weigh on growth

Canada’s automotive production declined sharply in 2024, and after another contraction this year only a modest 1.6% rebound is forecast in 2026. The main reasons are tariffs and plant shutdowns. Several major facilities remain idle while retooling extends into late 2026.

The renegotiation of the USMCA envisaged in 2026 could affect Canada's competitiveness, depending on any changes made. Due to the downside risk, the credit risk is increasing in the automotive supplier’s segment.

Looking ahead, the industry is pinning its hopes on the EV transition. Planned upgrades to manufacturing facilities could eventually drive a recovery, but the recent slowdown in EV demand is tempering expectations for a near-term rebound.

Mexico

Tariffs trigger rising production costs and longer supply timelines

We expect Mexico´s automotive production to decrease by 1.1% in 2026. The introduction of US import tariffs and regulatory barriers are raising production costs and lengthening supply timelines.

While vehicles and parts from Mexico that are compliant with the USMCA trade agreement will only be tariffed on their non-US content, the tariff shock and related uncertainty could dampen investment.

OEMs and suppliers have to adjust their production strategies in the face of increased volatility.

China

A sales slowdown in 2026 after robust growth over the past two years

Policy support for EV acquisition and a trade-in programme targeting older internal combustion models is driving growth in 2025. However, due to a certain saturation and subdued consumer sentiment we forecast automotive output to contract by 0.6% in 2026.

The Chinese automotive market continues its transition towards greater EV production, with EVs overtaking internal combustion engine (ICE) sales in the passenger car segment for the first time last year.

Credit risk in the EV sector is increasing, due to overcapacities and fierce competition. A price war has been ongoing for two years, and average EV sales prices have decreased by about 20% in this period. Despite sales growth, this has led to dwindling margins of producers and suppliers alike.

A lot of smaller private-owned businesses in the EV segment are not yet breaking even due to high input costs. Without continuous capital flow, those firms could quickly fail. There have been several insolvencies over the past couple of years.

Suppliers suffer from late payments of up to six months, reinforced by the strong negotiating power of manufacturers vis-à-vis suppliers.

We expect a market consolidation in the mid-term, in which the leading profitable producers prevail by adjusting their cost structures to accommodate permanently lower prices and by expanding their exports.

Japan

An output contraction expected in 2026

We expect Japanese automotive production to decrease by 3.9% in 2026 after a 4.3% increase in 2025. Domestic and overseas demand will be subdued.

While US tariffs on Japanese auto exports have been lowered from 25% to 15%, this remains significantly elevated compared with the previous rate of 2.5%. At least the reduction of the tariff rate should offer Japanese automotive producers greater flexibility to absorb the cost hit and avoid vehicle price hikes.

Several Japanese OEMs have announced plans to invest and increase production in their US production plants. Shifting more production to the US could potentially mitigate some of the disadvantages caused by tariffs.

South Korea

Seriously impacted by US import tariffs

After contractions in 2024 and 2025, we expect South Korean automotive production to decrease again in 2026, by 6.3%. Domestic and external demand are decreasing.

While US tariffs on South Korean auto exports have been lowered from 25% to 15%, this remains significantly elevated compared to a previous zero-tariff rate.

South Korean car exports to the US amounted to USD 43 billion in 2024.

South Korean OEMs have invested heavily in EV technology and have established themselves as major exporters of EVs. However, the US administration has reduced tax incentives for EVs, which will additionally dampen South Korean car sales in America.

Europe

Persisting problems and higher credit risk

The European automotive industry remains in troubled waters, with a modest production growth forecast of 1.6% in 2026 after contractions in 2024 (-5.1%) and 2025 (-2%). Demand across the region remains weak.

Europe’s own transition to EVs is proving challenging. Plants are being retooled away from internal combustion models, but regulatory requirements and the high cost of compliance are slowing progress.

EU tariffs may slow the momentum of EV Chinese imports, giving European producers a window to launch a new generation of more competitive vehicles.

Uncertainty over semiconductor/rare earth procurement and rising tariffs are driving up costs and forcing OEMs to reconsider sourcing and investment strategies.

We observe shrinking margins and increasing payment delays and insolvencies in major markets. Many Tier 2 and Tier 3 suppliers could lack the technological or financial means, or both, to climb up the value chain, and may be forced to leave the market in the coming years.

France

Deteriorating credit risk along the value chain

After a 11.4% contraction in 2024, French automotive output is expected to grow by 2.4% in 2025 and 1.9% in 2026. However, this modest recovery will be fragile among structural challenges and global trade frictions.

Profitability suffers from several factors: lower demand, rising costs for raw materials and logistics, investments in electrification, increasing regulatory pressure and fierce competition with Chinese EVs.

Considering the major challenges, we expect a deterioration of credit risk for the whole sector. OEMs and large Tier 1 suppliers have been rather insulated so far, but 2025 marks a turning point with a notable decline in performance.

Credit risk is highest among Tier 2 to Tier 4 suppliers. In this segment low pricing, slowdown in demand and tight operating margins has led to several defaults, from small to larger-sized businesses. We expect insolvencies to increase further in the coming months, mainly among smaller players.

Germany

The automotive industry is facing continued pressure

After contractions in 2024 and 2025, we expect another production decrease in 2026, by 2.7%. The decline underscores how both trade and policy risks are reshaping Europe’s largest car market.

The industry is challenged by weak demand, shrinking margins, tariffs and the shift away from internal combustion engines towards EVs – all at the same time.

German manufacturers, which shipped USD 33 billion worth of cars to the US in 2024, are particularly vulnerable to the 15% US tariffs on EU car exports. With the US serving as one of Germany’s most important export destinations, the new duties threaten to cut deeply into volumes and margins.

Suppliers in particular are under increasing pressure. The insolvency situation remains tense, and non-payments have approached the level seen in 2024. Banks are becoming increasingly restrictive in providing loans to automotive suppliers.

In particular smaller Tier 3 and Tier 4 suppliers are in troubles. Many are still focused on the manufacture of combustion engine components and are facing enormous conversion costs in order to secure their future.

In order not to lose the US market, several German OEMs are planning to set up production facilities in the US. Sooner or later, suppliers will have to follow suit and also relocate to the US in order to survive. However, many smaller suppliers will not be able to afford this.

Italy

Credit risk has increased over the past two years

Automotive production in Italy is decreasing. The contraction also affects component manufacturers, suggesting a broader slowdown across the entire supply chain.

The negative trend is further exacerbated by delays in the transition to electric mobility, high operating costs, weak EV demand, unstable incentive schemes, and intensifying competition from Chinese manufacturers.

Credit risk in the Italian automotive industry has increased over the past two years. Gearing is high and automotive businesses show low solvency, with the exception of a few OEMs and Tier 1 suppliers.

Margins are generally slim along the value chain. Price pressure from OEMs is eroding suppliers´ margins, adding pressure on their ability to generate operating cash flows and preserve liquidity.

We have seen increasing insolvencies in the sector in 2025 so far, in particular in the suppliers for combustion engines vehicles and tyre segments. We expect insolvencies to increase further in the coming months.

United Kingdom

The market environment remains challenging

The UK’s automotive sector is facing a period of challenges, among them cautious consumer spending on big-ticket items, changing EV regulations and high labour costs. We expect UK automotive output to decrease this year.

Manufacturers have overcome the worst of the post-covid production bottlenecks, but now they are facing moving goalposts when it comes to the impending EV transition.

In the course of 2025 insolvencies across the subsectors of vehicle manufacturing have decreased year-on-year, but increased in the retailers’ segment, where rates are significantly above industry average.

US tariffs on UK automotive exports have been cut to 10%, from 27.5% previously). This will give UK auto manufacturers some respite, but pressures on margins will remain.

Almost 60% of UK car exports go to the EU, while about 50% of parts are sourced from Europe. This makes regulatory alignment and the EU–UK trade deal critical for long-term competitiveness.

Interested in finding out more?

Download the full report in the related documents section below for a detailed analysis of the challenges, performance, and credit risks facing the consumer durables/retail industry’s major markets throughout the world.

To explore to strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

- Global: We expect global motor vehicles and parts production to grow by 1.6% in 2025, followed by a 1.2% contraction in 2026. This decrease is partly due to the US tariffs

- USA: Tariffs trigger lower production and sales and put pressure on margins for OEMs and suppliers. But the sector remains fundamentally sound

- China: A sales slowdown in 2026 after robust growth over the past two years, while credit risk in the EV sector is increasing

- The European automotive industry remains in troubled waters. Transition to EVs is proving challenging. We observe shrinking margins and increasing payment delays and insolvencies in major markets

- Germany: The industry is challenged by weak demand, shrinking margins, tariffs and the shift away from internal combustion engines towards EVs – all at the same time.