Future of construction industry not all doom and gloom

There are ongoing difficulties in China’s real estate sector, labour shortages in Europe and the US, and high costs of construction materials. For the residential sector, a lagged delay between lowering interest rates and the cost of mortgages, has resulted in higher credit risk for construction businesses.

However, the outlook for the industry is not all doom and gloom. We expect to see global construction output increase by 2.3% in 2025 and, as it starts to gain momentum, it should reach 3.3% by 2026.

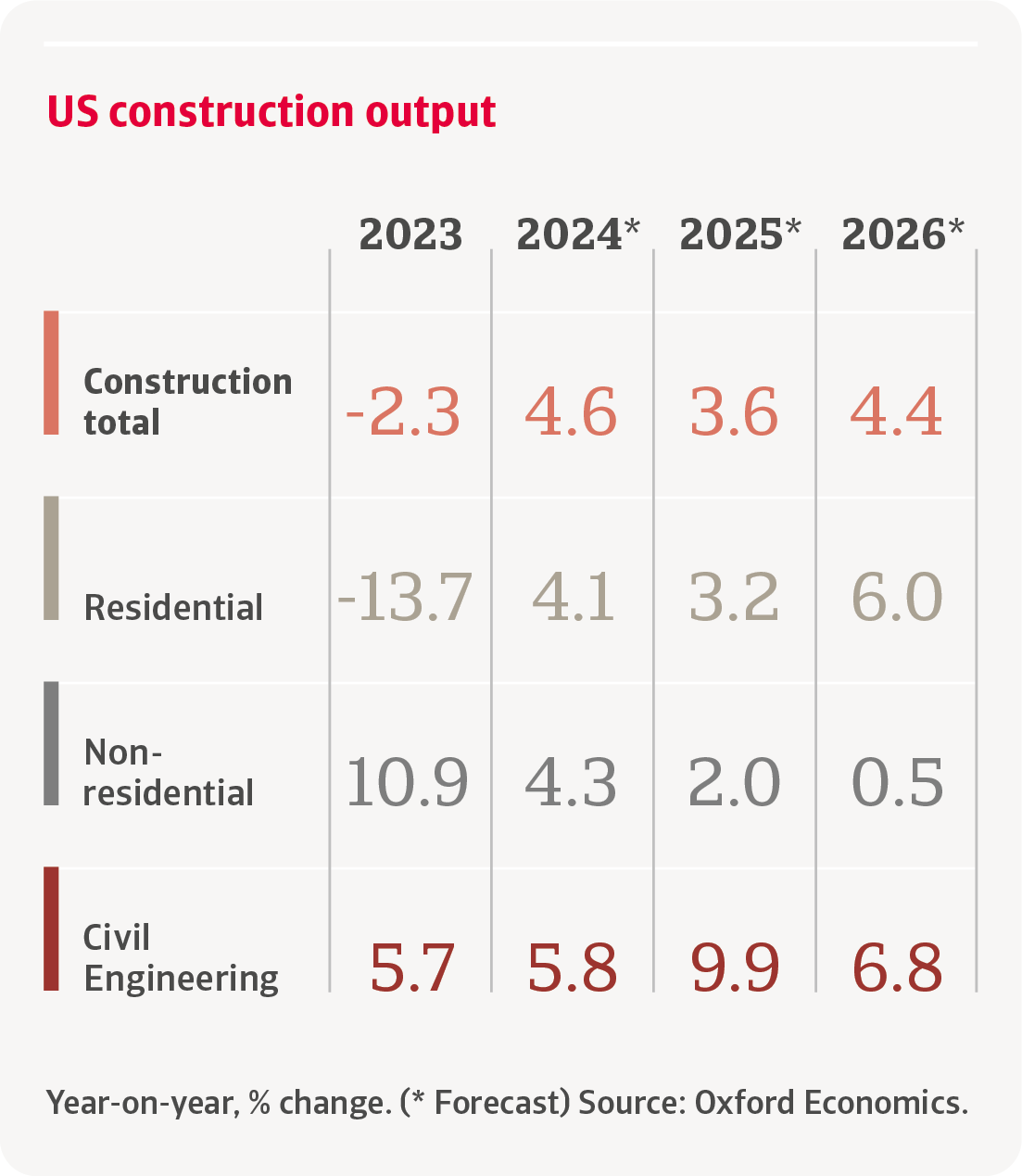

Construction in North America: Solid growth in the US expected.

In the US, construction output is forecast to grow 3.6% in 2025 and 4.4% in 2026.

Civil engineering will benefit from the Infrastructure Investment and Jobs Act, while lower interest rates should support the residential construction segment.

The same cannot be said for the solar-related construction segment. It is likely that incentives, subsidies and projects in the solar space will contract under the new administration.

Construction in Asia Pacific: credit risk of businesses remains high despite solid activity.

Asia Pacific accounts for 45% of the world’s construction output. Urban migration in Asia’s emerging markets is the main driver behind this statistic. Government investment in public projects is also a key driver of growth.

We expect construction output growth in China to slow to 0.8% in 2025, largely because of the depressed real-estate sector, where credit risk remains higher than the infrastructure sector.

In Southeast Asia public projects underpin construction growth. However, many businesses are leveraged, and high competition results in pressure on margins.

Australia’s residential segment is the most vulnerable to insolvencies, but we see defaults and failures in all of the subsectors.

"Project delays and volatile material prices are leading to liquidity shortages in South East Asia."

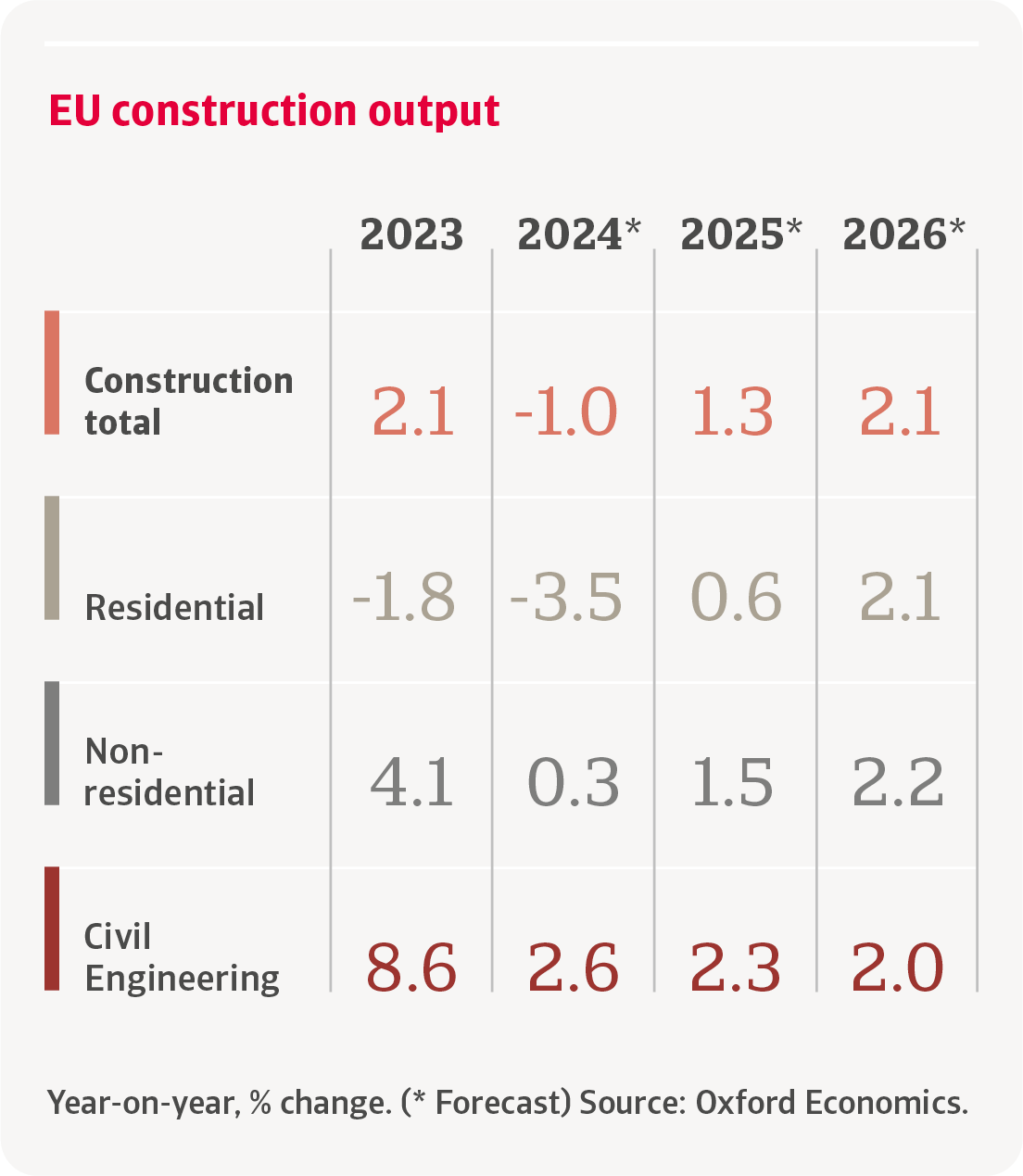

Construction in Europe: A feeble rebound with ongoing liquidity issues.

After a contraction last year, we expect a modest rebound of 1.3% in 2025 and 2.1% in 2026 for EU construction output, driven in part by further interest rate cuts.

However, this cautiously optimistic outlook does not extend to all of Europe’s markets. 2025 growth expectations for France, Germany and Italy remain below 0.5%. In these countries the residential construction segment is forecast to contract again this year, as the effect of monetary easing is lagged.

Credit risks for construction businesses remain high in most major European markets, with tight margins and liquidity issues especially impacting smaller builders.

Download the report for a detailed analysis of the construction industry's challenges, performance, and credit risks worldwide.

- Global construction output is expected to increase by a modest 2.3% in 2025 and by 3.3% in 2026.

- Infrastructure has been a major growth driver over the past two years. The civil engineering sector has benefited from government investment in infrastructure projects in many markets.