Atradius Atrium

Get direct access to your policy information, credit limit application tools and insights.

Ireland

Ireland

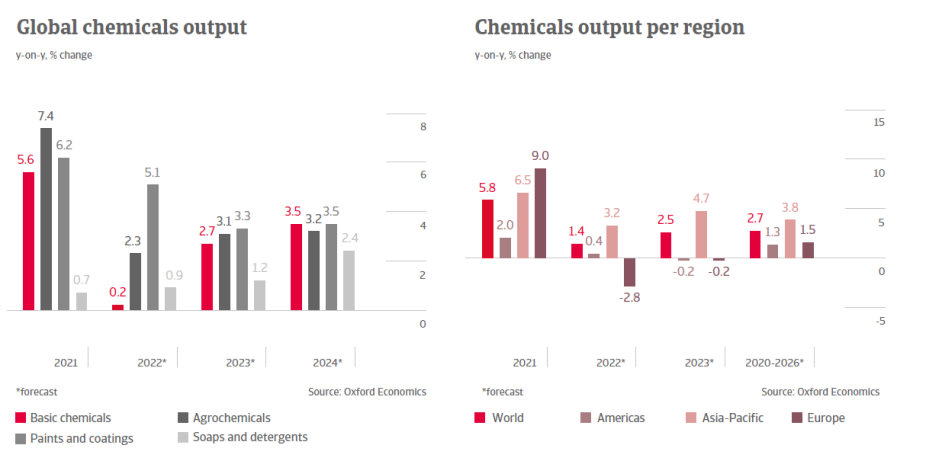

Shortage of gas/gas rationing: The chemical industry is very energy intensive and requires high levels of natural gas as feedstock. There is looming uncertainty about the war in Ukraine and its destabilising effect on energy supply, for Europe in particular. Major gas shortage or gas rationing measures would severely affect European chemical producers.

Regional cost competiveness: The US shale gas boom has restructured the landscape of the global chemical industry, particularly for basic chemicals. The US chemical industry has a feedstock cost advantage due to low and more stable gas prices, attracting larger investments. Other regions, in particular Europe, are facing a long-term competitive disadvantage.