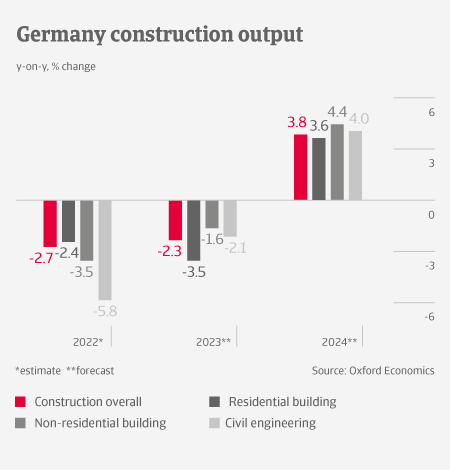

After performing relatively well in 2021, the German construction industry has faced severe headwinds since early 2022. Output contracted across all main subsectors in 2022, and this deterioration continues in 2023. Ongoing supply chain issues, high prices for energy and raw materials and increased interest rates weigh on the industry. Lack of skilled labour force is an issue, and higher wage costs additionally weigh on builders´ financials.

ncreased costs of financing construction projects has led to postponements of projects or cancellation of orders. While the Federal Government has set itself the goal of constructing 400,000 new dwellings every year, this target has been missed by a long way in 2022, and the same is expected this year. Higher interest rates and inflation make property purchases by households harder. We expect residential construction output to contract by 3.5% in 2023. Builders find it difficult to pass on price increases to customers unless escalation clauses are part of the contracts, which is often not the case (meanwhile builders try to negotiate price clauses for new projects).

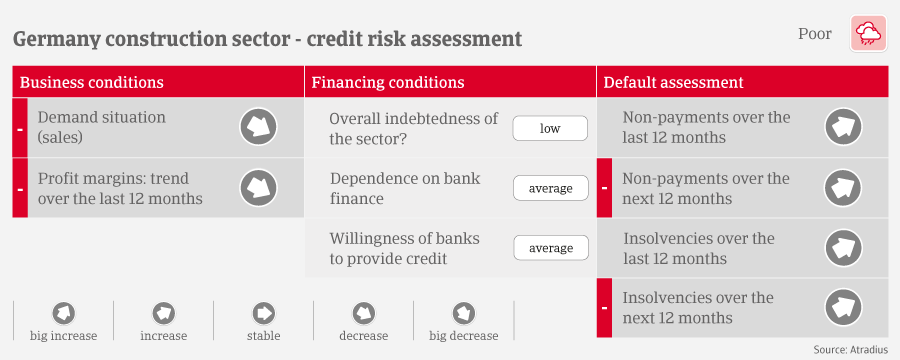

Due to all the issues, profit margins of construction businesses have started to deteriorate, and this negative trend will continue in the coming months. Payments in the industry take 30-60 days on average, and the payment behaviour was good in 2021 and early 2022. However, since then both payment delays and insolvencies have started to increase. According to the German statistics office, construction business failures increased 10% year-on-year in the period January-October 2022, compared to a 2% increase across all industries. We expect the deterioration to continue in 2023, with construction insolvencies increasing by 25%-30% year-on-year in 2023. Small and medium-sized businesses are most at risk (in the German construction sectors 85% of companies have only 20 employees or less).

Due to the deteriorating credit risk situation and business performance of the industry, we have downgraded our sector assessment from “Fair” to “Poor” by the end of 2022. We expect the sector to rebound in 2024, growing by more than 3.5%. Shortage in housing facilities and a big necessity for infrastructure investment should support construction activity in the years to come.