Global outlook is largely positive

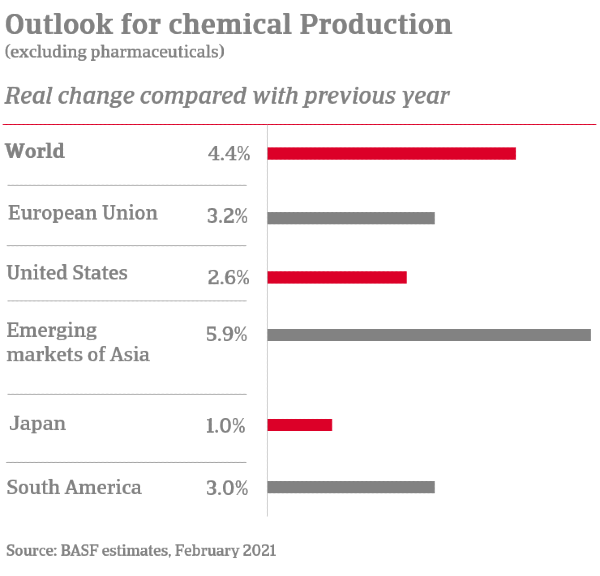

The global outlook for chemical production is positive, with growth projected by most analysts, especially for China and emerging economies. According to BASF, global chemical production (excluding pharmaceuticals) is expected to grow by 4.4% in 2021. This is above average for the years prior to the coronavirus pandemic and represents a strong rebound following the pandemic recession where overall global chemical production contracted by 0.4% in 2020, (compared to an increase of 1.9% in 2019).

Global Chemical Market - Overview

Projected Performance 2021

-

4.4% increase in production

- Growth predominately in emerging markets

- 2.5% growth rate in advanced economies

Growth in the agrochemicals sector

The demand for agrochemicals is expected to be the highest in Asia Pacific, where there is a strong agriculture tradition. India, Sri Lanka, China and Vietnam, in particular, are heavily dependent on agriculture and related industries for economic growth. A key trend seen in the agrochemicals segment in recent years is an uptick in M&A activity. The global agrochemical market is witnessing consolidation that is contributing to volume declines in some measures but overall creating some examples of large powerhouses.

Growth in the speciality chemicals sector

This growth is being driven by increasing demand for high-performance and function-specific chemicals. The industrial and institutional cleaners segment accounted for the largest market revenue share of 8.6% in 2019 and is projected to witness a growth rate of 4.0% over the forecast period. The CASE segment that includes coatings, adhesives, sealants and elastomers is also emerging as a potentially lucrative area and accounted for a value share of 3.4% in 2019. Construction chemicals are also expected to emerge as one of the prominent product segments with significant growth projections between 2020 and 2027.

Growth in the consumer chemicals sector

Healthy growth is also predicted for the consumer chemicals sector, particularly within the cosmetics and aroma segments. Asia Pacific is the largest regional market for aroma chemicals. It captured a revenue share of 29.6% in 2019 and most forecasts predict continued market dominance driven largely by the fragrance, food and beverage industries in China, India and Japan. The global aroma chemicals market size was valued at USD 5.5 billion in 2019 and is expected to grow at a compound annual growth rate of 5.8% between 2020 and 2027.

Environment, social governance and sustainability

Environmental and social governance (ESG) issues are at a tipping point for the chemicals industry and are impacting businesses across the sectors. This can be seen in both push and pull influences as companies respond to regulatory directives, customer preferences and boardroom guidance. In addition to chemicals regulations in most major markets including the US, Europe and China, there is growing demand among consumers for ‘green’ and ethical products. ESG performance is expected to be benchmarked as highly as cost and other productivity metrics.

Technological developments

The ongoing adoption of technological developments is a feature of the chemicals industry that can be seen in every segment and creates both opportunities and risks. The growing need for process efficiency is driving the adoption of technologies such as IoT (Internet of Things) sensors for both production processes and end product performance. There is also an increasing adoption of blockchain technology to enable supply chain transparency and product traceability around the time-specific delivery of chemicals in end-markets.