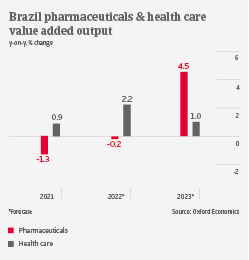

Brazil has the sixth largest generics industry worldwide, and the biggest in Latin America. In 2022 pharmaceuticals value added output is expected to level off, but is forecast to grow 4.5% in 2023. Brazil´s pharmaceutical production relies heavily on commodities from China and India (more than 90%). Supply chain shortages due to the pandemic and depreciation of the real have made those imports more expensive, leading to higher input prices for drug producers. However, pharmaceutical retailers reported a 12% increase in drug sales in 2021, with further growth expected this year. Despite current inflationary pressures, we expect profit margins of pharmaceutical producers, wholesalers and distributors to remain stable this year.

In 2022 and 2023, demand for drugs is likely to be stronger in the private sector, given current constraints in public sector spending. Pharmaceutical producers will benefit from ongoing demand for Covid-19 vaccines. Wholesalers and retailers have tapped into cosmetics as an additional growth segment. Pharmacies and drugstores benefit from increased demand for all drug segments (branded, generic, OTC), with a growing share of e-commerce.

Brazil’s pharmaceuticals and healthcare sector will see robust demand in the mid- and long-term, due to a rapid change in demographics (the share of population aged 60 years or older is forecast to reach 19% in 2030). The number of chronic diseases like diabetes is rising, which will spur demand for more complex medical treatments. However, producers of brand-name drugs face the issue that public healthcare is obliged to favour the purchase of generics, even when sales prices are comparable.

Most pharmaceutical businesses have good access to bank financing. During the pandemic, larger drugstore chains used bank loans to reinforce their cash position and liquidity. Payment duration in the sector is 90 days on average, and payment behaviour has been good over the past two years. The amount of both payment delays and insolvencies has been low over the past 12 months, and we expect no major change in 2022.