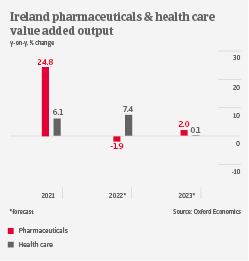

The small country accounts for more than 5% of global pharmaceuticals production, and recorded a whopping 25% increase in value added output in 2021. The highly export-driven Irish pharmaceuticals sector benefits from ongoing vaccine production and the global rebound in non-Covid related healthcare spending.

Drug production is very profitable, and increased turnover has led to higher net profits for wholesalers and distributors. However, pharmacies and drugstores suffered in 2020 and 2021 due lower footfall, as sales of higher margin goods (cosmetics, perfumes etc.) declined. Due to the pandemic, there is still a significant backlog for consultant appointments and non-urgent operations in the domestic healthcare market.

As of 2023, multinational pharmaceutical businesses with operations in Ireland and revenues of more than EUR 750 million (USD 840 million) will face an increase of the corporate tax rate from 12.5% to 15%. Additionally, a growing shortage of qualified staff is leading to wage inflation. However, as Ireland is a major drug production hub, multinational producers will benefit from growing overseas demand in the coming years.

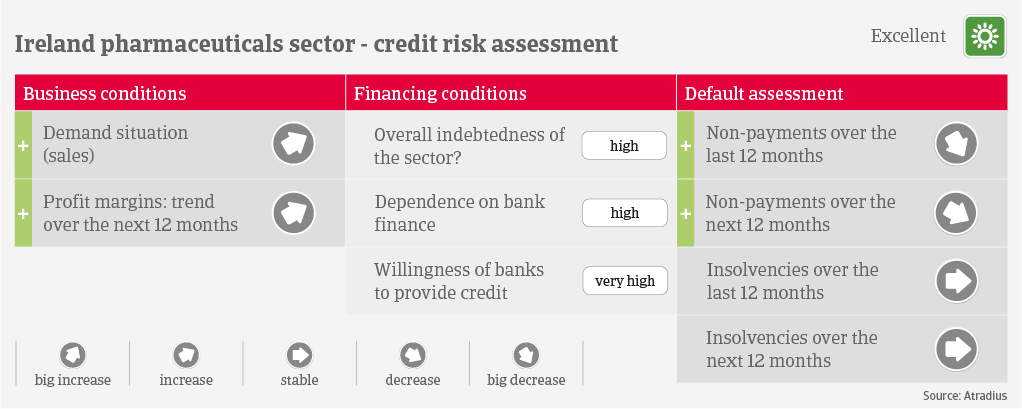

Financing of pharmaceutical producers is mainly driven by foreign direct investment made by parent companies. Banks are very willing to provide loans to smaller businesses, and private equity funding is also available. Payments in the industry take 60 days on average, and payment behaviour has been very good over the past two years. Compared to other Irish industries the insolvency level is very low.

Due to the low credit risk and the financial strength of most businesses, our underwriting stance is very open for pharmaceutical producers. The same accounts for the wholesalers/distributors segment, where recent mergers and takeovers have reduced the number of players in the market. However, we are restrictive for pharmacies/drug stores, as sales have not yet recovered to pre-pandemic levels. Competition in this segment is fierce and margins are very low, and an increase in business failures in 2022 cannot be ruled out.