Atradius has released an updated Industry Forecast per Market, providing business performance and credit risk assessments from our underwriters. The chart covers key sectors across representative markets in Europe, the Americas, and Asia-Pacific, reflecting global economic activity.

.2025-12-15-15-53-56.png)

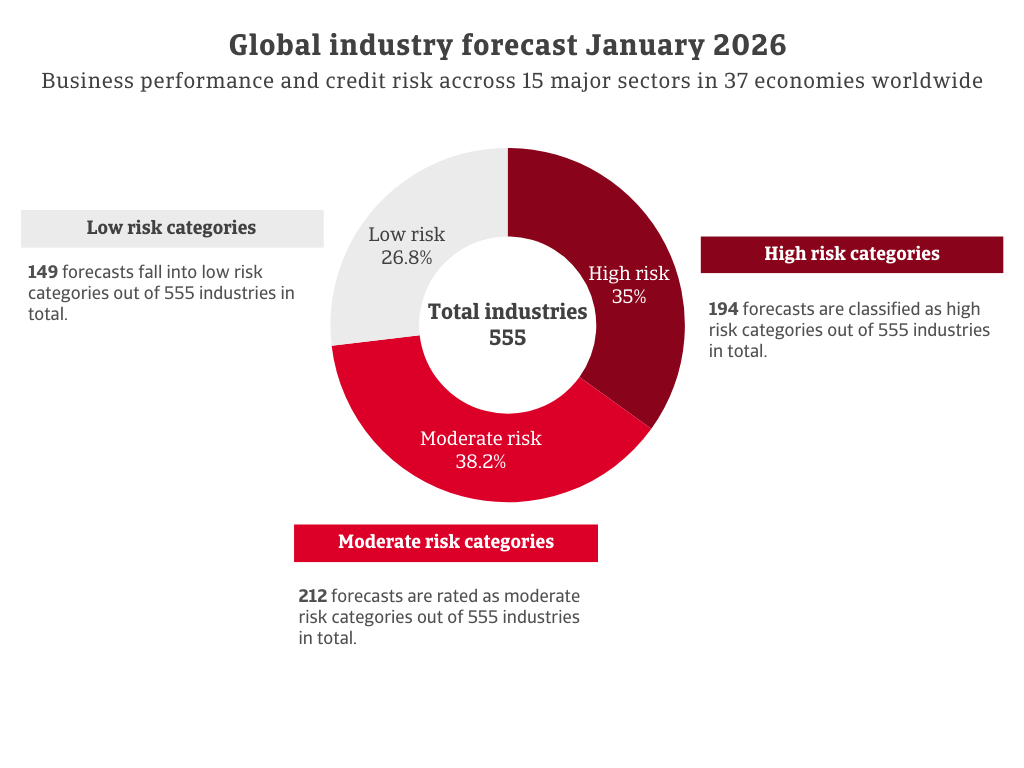

In total, 555 forecasts have been issued: 149 fall into low risk categories, 212 are rated as moderate risk, and a significant segment of 194 is classified as high risk. Forecasts for food, pharmaceuticals, financial services, chemicals, electronics/ICT, and agriculture are more favourable than the overall benchmark. Machines/engineering and services remain at mid-range risk levels. Transport, automotive, consumer durables, and paper show elevated risk. The most negative outlook is concentrated in construction, metals/steel, and textiles.

Download the Industry Forecast per Market chart in the Related Documents section below.

Europe: Changes since August 2025

Belgium

Electronics/ICT – up from poor to fair

Payment delays and credit insurance claims have declined in the industry over recent months. The electronics sector shows modest growth, with a CAGR of just 0.5% (2023–2028). Belgium exports about EUR 12 billion worth of electrical machinery and electronics, ranking eighth globally. Other growth drivers include the rise of e-commerce in electronics and strong adoption of digital technologies across electronics-related industries.

Financials services – up from fair to good

Belgian banks have diversified balance sheets with a high share of non-loan assets, making them less exposed to monetary policy changes than banks in some other markets. The financial sector is well capitalised, supported by strict regulation and recent strong profitability. Credit risk has improved in recent months. Strong core performance, digital innovation, regulatory stability and tech-driven efficiencies have all contributed to the industry’s improved momentum in 2025.

Paper – up from bleak to poor

Credit risk in the sector has improved, with fewer payment delays in the second half of 2025. Growth in e-commerce and a shift towards eco-friendly packaging have spurred investment in advanced pulping technologies, recycled fibre use and cleaner production processes. However, major challenges remain. Digitalisation has caused a structural decline in demand for printing and writing paper. Energy-intensive production and volatile pulp prices raise operating costs, while fierce competition from low-cost producers in the Global South and neighbouring EU countries continues to squeeze margins.

Textiles – up from bleak to poor

Credit risk in the sector has improved, with fewer payment delays in the second half of 2025. Output is projected at roughly EUR 1.8 billion, with a slight positive growth trend reversing years of stagnation, driven by rising demand for technical textiles and sustainable fabrics. However, significant challenges persist. Brick-and-mortar retailers face thin margins and growing competition from e-commerce. High labour costs and still-elevated energy prices remain key concerns.

Denmark

Agriculture – up from poor to fair

Agricultural prices are recovering, boosting the performance of grain and feed businesses. However, investment in farm equipment remains low, which is holding back an upgrade to “good”.

France

Agriculture – up from poor to fair

We expect grain and crop production in France to rebound in 2025/26 after a weak 2024/25 season caused by bad weather. However, low grain prices continue to put farmers under pressure, and labour shortages persist. The amount of credit insurance claims has decreased.

Electronics/ICT – down from good to fair

Credit risk remains relatively modest, and demand for value-added products such as cybersecurity solutions is still dynamic. However, growing economic uncertainty has made businesses reluctant to invest heavily in IT hardware, adding pressure to this subsector.

The Netherlands

Chemicals – down from fair to poor

Dutch chemical production remains more than 20% below peak levels, with no sign of recovery and limited investment in modernisation. Persistently high energy prices and strict environmental rules are squeezing margins, leading to plant closures and divestments. Credit risk has risen due to falling earnings and high leverage in the sector.

Poland

Consumer durables – up from poor to fair

Consumer spending is supported by economic growth, loose fiscal policy, lower interest rates and reduced inflation. Sales of semi-durable and durable goods have increased, showing consumers’ willingness to make larger purchases. In 2026, the minimum wage rise will be much smaller than in previous years, which should help reduce costs for producers and retailers.

Machines/engineering – up from poor to fair

Machinery production picked up noticeably in 2025, and the outlook remains positive. Investment in capital goods is expected to drive growth in 2026, supported by faster disbursement of EU funds. After three years of sharp decline, domestic demand for agricultural machinery is rising.

United Kingdom

Agriculture – up from poor to fair

Despite typical challenges such as adverse weather and post-Brexit bureaucracy, the sector mainly consists of long-established, financially robust businesses. Credit risk has improved in recent months.

The Americas: Changes since August 2025

Canada

Metals/steel – down fair to poor

Performance in the steel sector has weakened, as the US-imposed 50% tariff is cutting off Canadian steel companies’ main export market and starting to affect sales and profits. Steel producers are aggressively pursuing cost-cutting measures, and layoffs are occurring. Both federal and provincial governments have begun providing loans to support the industry and are requiring companies with government contracts to buy Canadian steel to help stabilise the sector.

Mexico

Automotive – down from fair to poor

We expect Mexico’s automotive production to fall by 1.1% in 2026. New US import tariffs and regulatory barriers are raising production costs and lengthening supply timelines, leading to slower payments. Increased uncertainty could dampen investment. OEMs and suppliers must adjust their production strategies to cope with rising volatility.

Food – up from fair to good

In 2025, Mexico’s food and beverage sector showed dynamism, innovation and adaptability to new trends. However, structural challenges remain, particularly in balancing sustainability, affordability and international competitiveness.

Transport – down from fair to poor

Sector growth is expected to slow in 2026 as the tariff-driven frontloading from 2025 fades. Vulnerability to changes in US tariff policy remains high. In trucking, cargo theft, border delays and driver shortages are ongoing issues. Trade bureaucracy has increased in recent years, adding administrative burdens. The outlook depends heavily on US economic conditions and the outcome of USMCA renegotiations.

United States

Transport – down from fair to poor

The US freight sector has been hit by falling consumer confidence and economic instability linked to tariffs, reducing demand for shipping durable and non-durable goods. Weaker trade with Canada and Mexico is affecting land transport, especially trucking. Labour shortages are causing delays and higher costs, and restrictive immigration policies could make the problem worse. The US trucking market is undergoing a difficult rebalancing, with smaller carriers exiting at an accelerating pace as volumes remain below seasonal expectations.

Asia and Oceania: Changes since August 2025

Vietnam

Consumer durables – down from fair to poor

Domestic consumption is not recovering strongly, as households continue to prioritise essential goods. Export markets remain uncertain due to the global economic slowdown and US tariffs. Retailers and manufacturers may face tighter cash flows, leading to weaker overall performance. Payment defaults in the sector have increased.

Construction/Construction materials – down from fair to poor

Vietnam’s real estate market remains under pressure due to regulatory tightening and limited access to financing. Developers may face liquidity constraints because of slow presales of projects in 2026–2027. Although policy rates are low, bank credit to the real estate sector is still tightly controlled, and lending is expected to remain restricted in 2026.

What is the Industries Forecast per Market?

The Atradius Industries Forecast per Market is a global chart that provides an expert view of business performance and credit risk across different sectors and markets. It covers 15 major industries in 37 representative economies. Each sector-market combination is assigned an opinion - excellent, good, fair, poor, or bleak - based on the insights of Atradius’ specialised risk analysts.

- Excellent: Strong credit risk situation and robust business performance

- Good: Benign credit risk with performance above long-term trends

- Fair: Average credit risk and stable business performance

- Poor: Relatively high credit risk with below-trend performance

- Bleak: Poor credit risk situation and weak business performance

These underwriters work from centres of expertise around the world, ensuring that every assessment reflects local realities and is informed by on-the-ground knowledge. This approach highlights the strength of Atradius’ risk management system and its ability to anticipate challenges in global trade.

Important note: While the chart offers a powerful overview, it is important to remember that risk does not reside in countries or sectors but in individual buyers. That is the true value of credit insurance: the ability of our underwriters to deliver a guaranteed, near-instant opinion on virtually any buyer worldwide, enabling businesses to trade with confidence.

To explore to strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

- The Atradius Industries Forecast per Market provides an expert view of business performance and credit risk across different sectors and markets

- It covers 15 sectors across 37 economies worldwide

- Each sector-market combination is assigned an opinion - excellent, good, fair, poor, or bleak- based on the insights of Atradius’ specialised risk analysts

- Upgrades/Downgrades in our sector assessments since August 2025