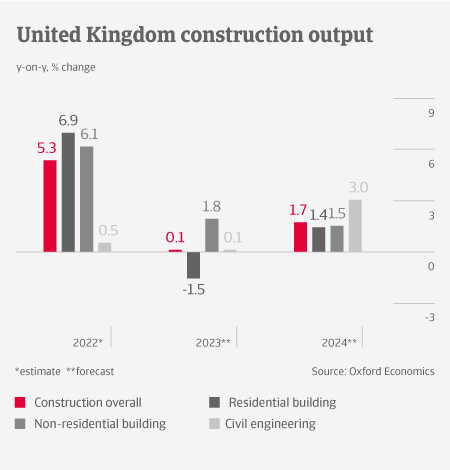

After growing by more than 5% in 2022, we expect British construction output to level off this year, with a 1.5% contraction in the residential construction subsector. Demand in this segment suffers from falling real disposable incomes, rising interest rates leading to higher mortgage interest rates, and the economic contraction in 2023 (forecast -0.7% year-on-year). We expect house prices to decline by more than 10% in 2023 and 2024. However, there are major infrastructure projects still going ahead (HS2, Hinkley Point and the Thames Tideway project), which support the sector´s performance. Additionally, ongoing Renovation Maintenance Improvement (RMI) work sustains the construction materials industry.

After growing by more than 5% in 2022, we expect British construction output to level off this year, with a 1.5% contraction in the residential construction subsector. Demand in this segment suffers from falling real disposable incomes, rising interest rates leading to higher mortgage interest rates, and the economic contraction in 2023 (forecast -0.7% year-on-year). We expect house prices to decline by more than 10% in 2023 and 2024. However, there are major infrastructure projects still going ahead (HS2, Hinkley Point and the Thames Tideway project), which support the sector´s performance. Additionally, ongoing Renovation Maintenance Improvement (RMI) work sustains the construction materials industry.

All major building segments have been hit by increased energy and construction material costs, which raises the question of how far builders are able to pass on higher input prices to their customers. Since the pandemic, all contracts have been generally negotiated with price escalation clauses. However, the issue of legacy contracts still exists for many businesses.

All major building segments have been hit by increased energy and construction material costs, which raises the question of how far builders are able to pass on higher input prices to their customers. Since the pandemic, all contracts have been generally negotiated with price escalation clauses. However, the issue of legacy contracts still exists for many businesses.

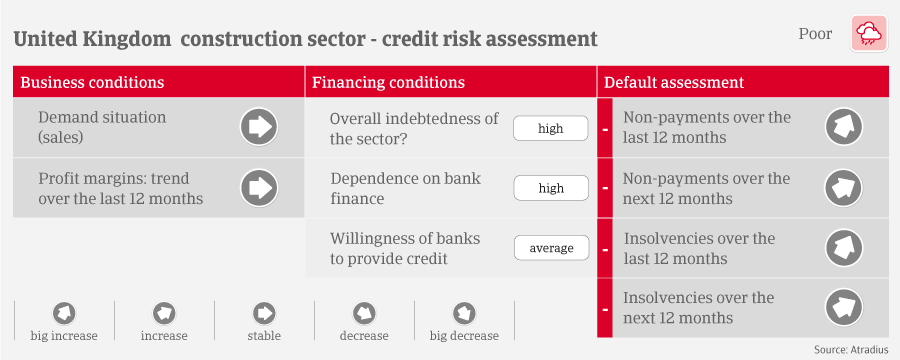

Payments in the construction industry take between 75-90 days on average. The number of overdue payments, payment plans, and insolvencies has increased at double digit-rates in H2 of 2022, although from a very low level. Companies´ liquidity is squeezed by increased input charges, with inflation and particularly wage increases putting pressure on their cashflow.

Another issue is the expiry of pandemic-related government support for businesses (during the lockdowns many companies have preserved cash, supported by several government schemes). Now, this financial support has to be repaid to HM Revenue and Customs.

Due to all these factors putting high pressure on the cash situation of businesses, we expect further rising payment delays this year and business failures to increase by about 10%. Given the deteriorated credit management situation of the construction industry, our sector outlook remains “Poor”. In particular, labour availability and wage costs have become serious problems for construction companies, and both Brexit and the pandemic have aggravated this issue. There is a shortage in all specialised building skills, which leads to higher labour expenses, adding to cost pressure for builders in the short and medium-term.